|

|

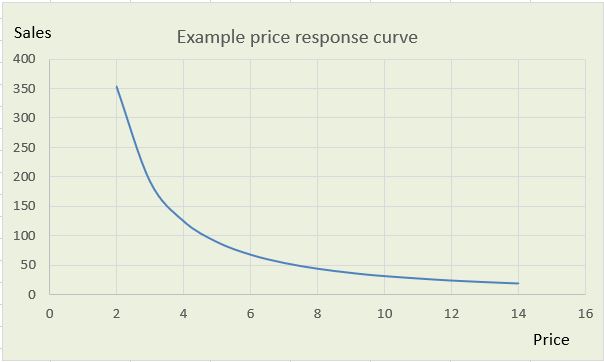

Price Sensitivity Analysis - Effect of Price on DemandPrice sensitivity analysis provides a measurement of the effect of price on demand. It helps in demand forecasting and in the formulation of a pricing strategy. Price sensitivity analysis is the process of defining the mathematical relationship between price and product demand. In a price sensitivity analysis Forecast Solutions carries out a causal analysis of historical company sales and prices using advanced statistical software. This method has a much lower cost and potential risk than would be incurred in a sequence of real-world experimentation or an elaborate market research project. Because the effect of price on demand usually relates to competitor prices, it can be helpful for the price sensitivity analysis to use a causal factor that is calculated as an index of price relative to total market or some key competitor price. If the business is subject to additional causal factors such as the weather or key economic indices such as household disposable income, it may be desirable to include such factors in a broader causal analysis. Price Demand CurvesA pricing model is the mathematical formula that is used to descibe price sensitivity in the form of a demand curve and a wide variety of mathematical models can be used. If weekly or monthly historical sales and price data is available over a good period of time, usually three years or more, this can be used in the price sensitivity analysis. The historical data may only cover a relatively small range of prices and one should be careful not to extrapolate results in the form of the pricing model much beyond the range of historical experience. So if the historical price of a product has varied between 1.35 and 1.60 it would be dangerous to use a fitted curve to predict the demand that would result from extremely different prices of 0.50 or 3.50.

Straight line (linear) relationships often give a good starting point in the price analysis and have the benefit that perfect mathematical solutions are available using the linear regression method that is widely available in software. Sometimes there are limitations of the available historical data, restricting the analysis to linear regression over a small range of price options, but the results can still be extremely useful. Response of demand to price is often quite rapid, but to achieve the most accurate interpretation of price sensitivity it is often necessary to explore the possibility of various time lags that may exist between price changes and their effect on demand. A number of other types of demand curve can be transformed to linear form using logarithmic mathematics, so are also relatively easy to use. These include poynomials, the exponential curve and the power curve. Other forms of curve may require the use of nonlinear regression using optimisation techniques that are available in specialist statistical software and often produce different results in different software.

Straight Line: Sales = a + bp a= constant. b = coefficient of price (this will be -ve), p=price Exponential curve: Sales = aebp where e = mathematical constant (approx. 2.7183) a = constant, b = coefficient, p = price Polynomial (2nd order): Sales = a + bp + cp2 a = constant, b = coefficient, c = coefficient, p = price Power curve: Sales = apb a = constant, b = coefficient (elasticity), p = price The power curve is somewhat special in that it exhibits a constant price elasticity of b (see below). Price ElasticityPrice elasticity is one way of describing price sensitivity and the effect of price change. Price elasticity is defined as the % change in sales likely to take place as a result of a 1% change in price. As increased price results in a reduction in demand the price elasticity of demand will always be a negative figure. Unit price elasticity refers to the specific situation where a 1% change in price causes exactly a 1% decrease in sales. In most price models, including simple linear relationships, the price elasticity will vary depending on the particular point of reference on the demand curve. So the elasticity from a point where the price is 8.00 may vary from the elasticity when the price is 9.00. The elasticity at particular price may is then referred to as the "point price elasticity of demand". Cause and Effect AnalysisIn cause and effect analysis, or causal analysis, the aim is to quantify the effect of factors which are suspected of causing shifts in sales volume or market share. Price sensitivity analysis in the form of pricing models and demand curves is one special example. Other causal factors such as unseasonal weather or economic indices may also play a part. So a full cause and effect analysis incorporating the effects of other factors as well as pricing may lead to a fuller understanding and a better platform for the formulation of pricing strategy and other business strategy When a causal relationship has been identified and quantified it can immediately help to explain variations that have been experienced in historical demand. That is in itself is very helpful, but to make full use of a pricing model or other causal model in forecasting it is necessary to forecast the future values of the causal factor itself before one can calculate the demand forecast. If the causal factor is a leading indicator and/or some well known index such as GDP or RPI for which other organisations publish forecasts, the task may be somehat easier. Need for expert helpSpecialist software is invaluable in carrying out price sensitivity analysis and other causal analysis. Care is needed to avoid confusion of the results with natural seasonality or inherent trends in market size or share. Also, it is usually necessary to explore a range of possible time lags in the response of demand to changes in the causal factors. Forecast Solutions can expertly carry out the work using specialist statistical software, analysing the effect of causal factors such as pricing, weather, economic indices or sales force calling patterns. The results can then be taken into account in defining pricing and other business strategy, and may be incorporated into the demand forecasting process. |